Tata Digital’s startup moves; ZestMoney CEO on women in fintech

Also in this letter:

- Interview with

ZestMoney CEOLizzie Chapman CoinSwitch is Andreessen Horowitz’s first India betMyGlamm acquires The Moms Co for Rs 500 crore

Tata Digital may offer stock options to woo top startup talent

Tata Digital may offer stock options to all its employees to attract and retain the top talent from the startup community, sources told us.

The company houses Tata Group’s consumer-centric digital businesses and competes with startups. It had first offered management stock options to the founders of BigBasket, in which it picked up a 64% stake in May, based on the startup’s past performance and the future potential of eligible employees.

It may now extend similar offers to other employees as well because many candidates it has interviewed have asked for them, the sources said.

What’s the issue? In its early days, Tata Digital hired senior talent from Tata Consultancy services, the world’s largest IT services provider. This caused some experts to question whether it could create a startup-like culture and empower younger talent to take on unicorns and other fast-growing Indian startups.

“It is all about building unicorns and encashing stock options within a short period of time compared to established older conglomerates, who are into institution building,” said G C Jayaprakash, founder director of boutique executive search firm Accrete Executive Search.

What it needs to do: Jayaprakash said Tata Digital would have to offer pay packets on par with those offered by startups. It will also need to rework its organisational structure — a challenging task but one that’s already underway.

In June, the company had named Mukesh Bansal, founder and CEO of fitness startup CureFit, as its president. While it has appointed Modan Saha, a senior TCS talent, as CEO of its financial services vertical, it is not clear if heads of other verticals will also be made CEOs.

Plans to raise $5B: Tata Digital is also seeking to attract early investors to raise an estimated $5 billion for its TataNeu, its ‘super app’.

Several long-term investors, including Canada Pension Plan Investment Board, Singapore’s Temasek Holdings, SoftBank Group, Abu Dhabi Investment Authority and two European money managers, have been sounded out for a potential deal, we reported in August.

‘The last couple of years have been great for women leaders’

ZestMoney CEO Lizzie Chapman, who cofounded the buy now pay later (BNPL) platform in 2015 — well before India’s digital payments boom — believes the time for BNPL in India has arrived.

Chapman, winner of the Woman Ahead award at the Economic Times Startup Awards 2021, told us in an interview that such firms will generate more market capitalisation here than anywhere else in the world.

Here are some excerpts from the interview:

Financial services have unfortunately been male-dominated in India. Was it a challenge to crack this space?

It is much better than three years ago. The last couple of years have been great for women leaders. There is definitely more awareness. In fintech, there are actually some very strong female founders – there is Upasana Taku who is leading Mobikwik’s IPO charge. Mabel Chacko and Dina Jacob of Bank Open are strong founders. We definitely could do better, and we do need more female VCs – but it takes time.

When you cofounded ZestMoney in 2015, the Indian fintech ecosystem was far smaller compared to now. What made you bet on Indian fintech?

[As an equity researcher at Goldman Sachs], I happened to spend a month in Kochi, understanding the gold lending space, visiting small gold shops and dealers on the streets of Kerala. It was just so obvious then that India was about to explode, both from a consumer finance perspective and economically as well.

Many people in India understand credit cards and zero-cost EMIs but not BNPL, which is still nascent. How is ZestMoney introducing BNPL to customers?

In India, we found that EMI is understood very well. People in India also understand the difference between credit and EMI. With credit there is a slightly negative connotation, but EMI doesn’t have that. In our outreach, we use the concept of EMIs to explain our product proposition. There is just so much overlap that frankly it’s all jargon. What is important is that customers and retailers understand the product.

Tweet of the day

What Andreessen Horowitz’s CoinSwitch bet means for India’s startups

CoinSwitch Kuber founders (from left) Vimal Sagar Tiwari, Govind Soni and Ashish Singhal

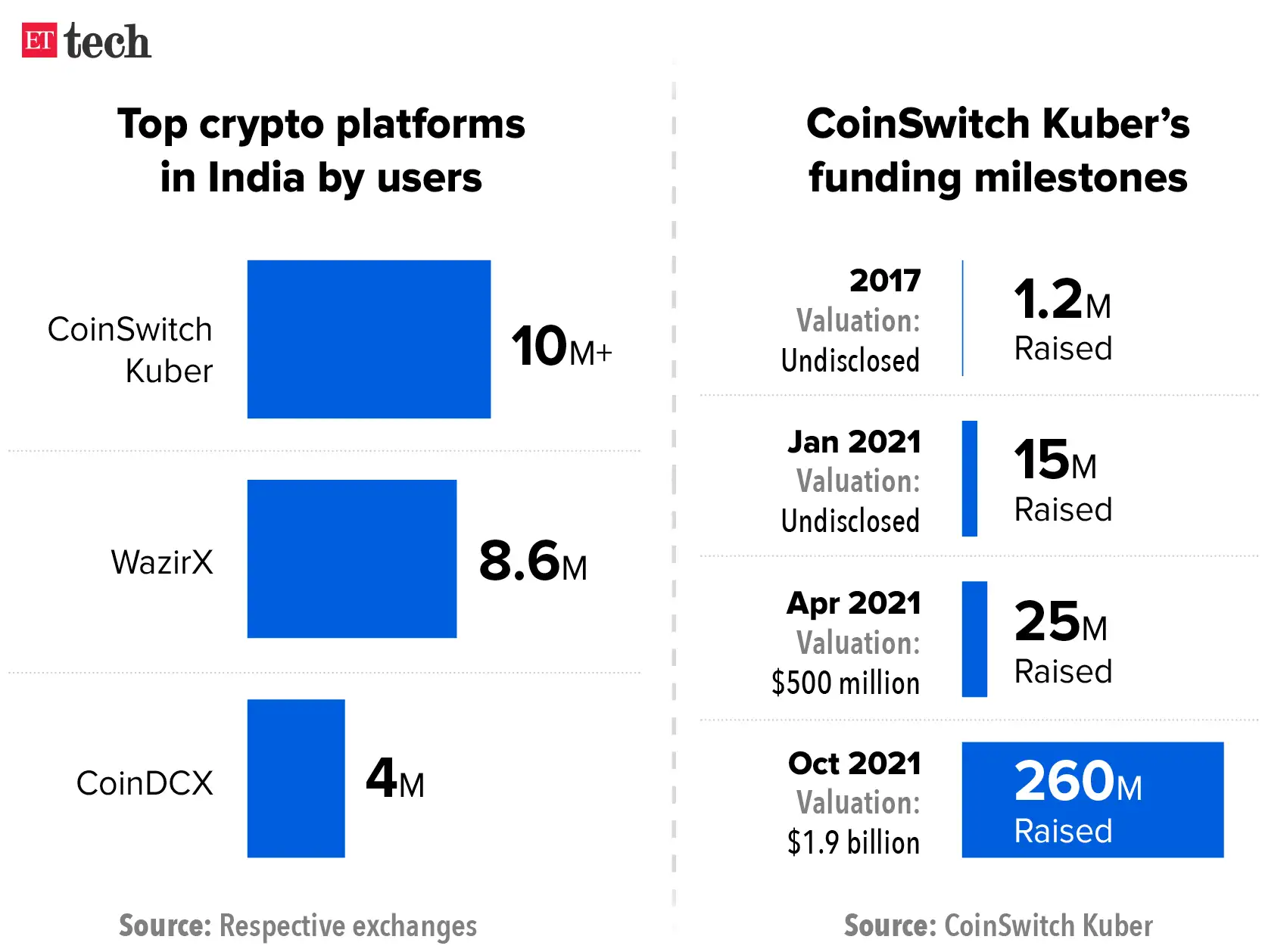

Crypto platform CoinSwitch Kuber’s latest funding checks several milestones for crypto and Indian startup ecosystem:

- It marks the entry of California-based venture capital firm Andreessen Horowitz into India. We first reported on September 16 that the firm was in talks to make its first India investment in CoinSwitch Kuber.

- It is the largest round—$260 million—raised by a crypto company in India

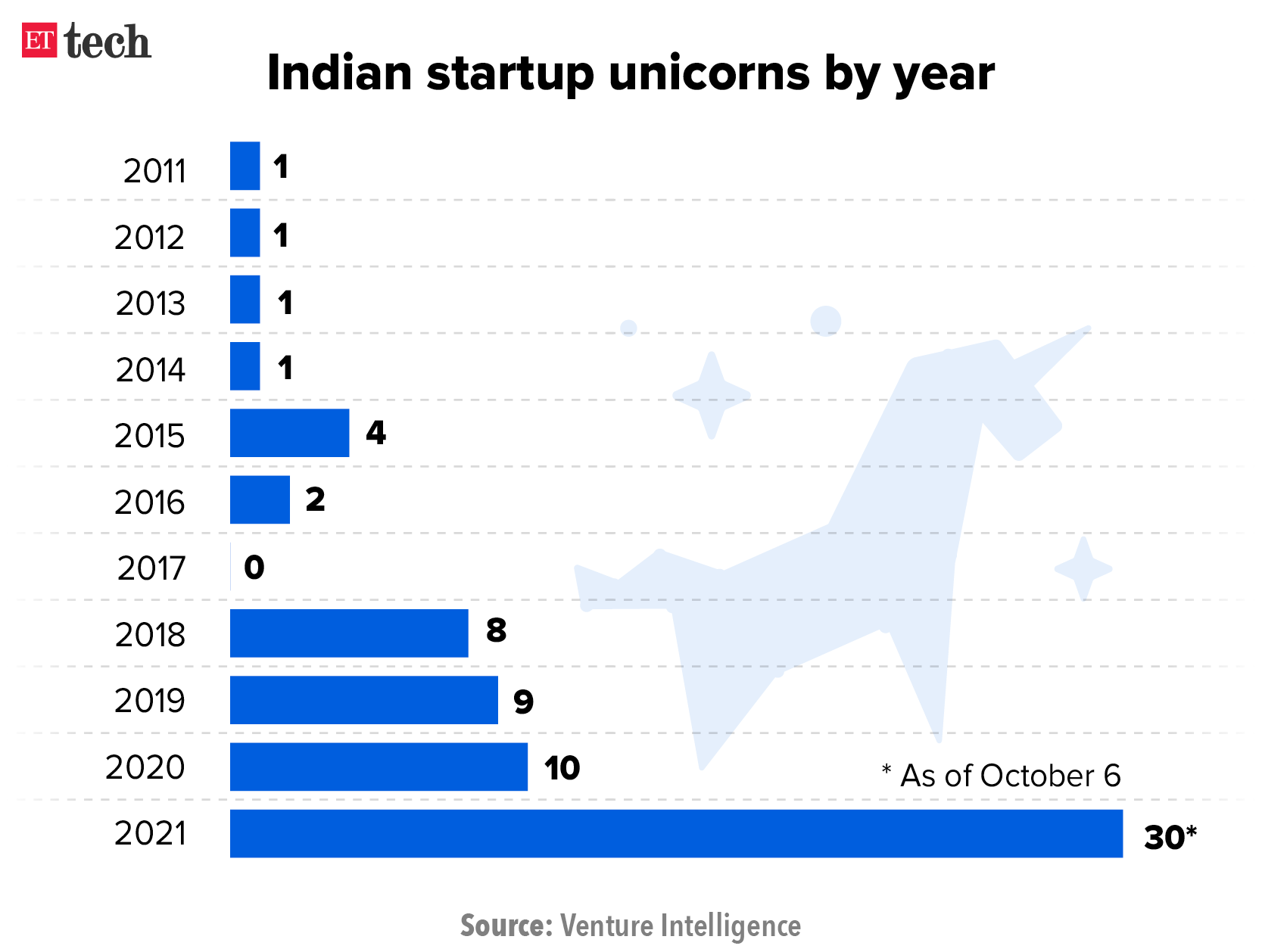

- It also makes CoinSwitch Kuber the highest-valued crypto startup in the country at $1.9 billion, a 4x jump from its last valuation in April, and the 30th Indian startup unicorn of 2021.

TLDR

- Both Coinbase Ventures, the corporate venture arm of Nasdaq-listed Coinbase Inc., and Andreessen Horowitz have co-led the round and invested $150 million and $80 million, respectively.

- It all began when CoinSwitch reached out to Andreessen Horowitz in July through Coinbase Ventures (Andreessen Horowitz was an early backer in crypto exchange Coinbase and also sits on their board).

- CoinSwitch Kuber has raised $300 million across three rounds this year—which were conducted all on Zoom

- Restricted rights: Coinbase will get restricted rights and CoinSwitch won’t share data with it since it could be a potential competitor, Singhal said.

- FYI: Coinbase Ventures also most recently participated in rival CoinDCX’s funding round, which catapulted the exchange into the unicorn club.

Why is it significant for Indian startups? Andreessen Horowitz’s entry into the Indian startup ecosystem comes amid frenetic funding from investors that have birthed 30 unicorns this year. According to industry tracker Venture Intelligence, Indian startups had raised $24.3 billion in total as of September 30, already surpassing last year’s amount by 2.2 times.

- The investment opens up Indian startups to Andreessen Horowitz’s $3.1-billion crypto fund, $1.4-billion biotech fund, healthcare fund, and cultural leadership fund.

- Sources told ET the VC is in talks with several startups for potential investments.

Regulatory flux: The meteoric growth of India’s crypto exchanges comes against the backdrop of regulatory flux, with little to no clarity from the government on whether crypto assets will be banned or not.

Read the full story for more.

Also read: India’s top 5 crypto platforms and what they offer

MyGlamm acquires The Moms Co for Rs 500 crore

The Good Glamm Group (formerly MyGlamm) has acquired direct-to-consumer (D2C) mother and baby brand The Moms Co.

Though the companies declined to provide details of the deal, sources said the transaction — a mix of cash and equity — would amount to Rs 500 crore (about $66.7 million).

This is the largest M&A deal in the D2C beauty and personal care segment, which has attracted huge interest from investors in the past year. The Good Glamm Group acquired Baby Chakra earlier this year and content and commerce platform PoPXo in 2020.

Experts suggest that the Indian beauty e-commerce industry could see a slew of acquisitions over the next 3 to 4 years as smaller, direct-to-consumer (D2C) brands reach scale, following a pattern established in the US.

Quote: “This acquisition gives us an entry into the skincare category and plays into the mom and baby category better,” Darpan Sanghvi, cofounder and CEO of Good Glamm Group, told us. “We are looking at growing The Moms Co. to a Rs 500 crore revenue run rate over the next 24 months,” he added.

Other done deals

■ Just five months after it was founded, Thrasio-style firm Mensa Brands has acquired 10 new-age brands in categories such as fashion, beauty and personal care, and home. Mensa, founded by former Myntra CEO Ananth Narayanan, has acquired anywhere between 51% and 75% stake in these brands and will grow them along with their original founders, Narayanan said. Karagiri, Priyaasi, Dennis Lingo, Ishin, Hubberholme, Anubhutee, Helea, Villain are among the brands in which Mensa Brands has picked up a majority stake. Each has an average revenue of $3-4 million.

■ Nazara Technologies, India’s first listed gaming company that is backed by billionaire investor Rakesh Jhunjhunwala, has raised Rs 315 crore from marquee investors by issuing fresh equity to them. The capital will be used for growth initiatives as well as to pursue strategic acquisitions across verticals to expand the company’s “Friends of Nazara” ecosystem, it said.

■ Qapita, an equity management platform, has raised $15 million in a Series A funding round led by East Ventures and Vulcan Capital to build an “operating system” for private markets in the Southeast Asia region. VC fund NYCA Partners participated in the fundraising, as did existing investors MassMutual Ventures and Endiya Partners and angels such as Anjali Bansal of Avaana Capital and Udaan cofounder Sujeet Kumar.

■ Electric scooters startup kWh Bikes has raised $2 million in a seed round led by LetsVenture, that also included Better Capital and Cloud Capital, Renu Satti (ex-CEO, Paytm Payments Bank), Vijay Shekhar Sharma (CEO, Paytm), Rajiv Nazareth (Project Manager, ALF Engineering), Paresh Sukthankar (ex-Deputy MD, HDFC), and Dipak Gupta (MD, Kotak Mahindra Bank), among others.

■ Tata Consultancy Services said that State Bank of India (SBI), India’s largest bank, has extended its contract for another five years as the bank embarks on its next leg of growth based on the three pillars of technology, resilience and people.

Facebook says it uses tech to detect hate speech in India

Facebook said it uses technology to proactively detect hate speech in Hindi and Bengali, and has reviewers flagging such content in 20 Indian languages.

What prompted that? The statement comes after former employee and whistleblower Frances Haugen filed a complaint with the US Securities and Exchange Commission (SEC) using internal company documents that cited “fear-mongering” content promoted by “Rashtriya Swayamsevak Sangh users, groups and pages”. The documents also said: “Our lack of Hindi and Bengali classifiers means much of this content is never flagged or actioned.”

Under-funded: Facebook allocated just 13% of its budget to counter misinformation and hate speech during the financial year 2020 to markets outside the United States, including India, according to the internal company documents. Facebook has 434 million monthly active users in India, more than twice as many as in the US.

Ecommerce firms rope in influencers to push festive sales

Online retailers have roped in a record number of regional actors, celebrities, influencers and social media content creators to push their festive sales along with national celebrities as the online retail battle enters tier 3, 4 and 5 towns.

Flipkart said it has collaborated with several regional celebrities across the country such as Dhanalakshmi (Tamil TV actor), Gauri (for Maharashtra), Amrapali Dubey (Bhojpuri actor) and Mahesh Babu (Telugu actor)

- Snapdeal has tied up with regional celebrities like Aarohi Patel and Shubhoshree Ganguly for campaigns in Gujarat and West Bengal.

- Myntra has roped in Vaani Kapoor, Yami Gautam and Mallika Dua, while Tata Cliq has signed Kalki Koechlin for its new campaign across platforms.

- Fashion platform Ajio has also released campaigns with Sidharth Malhotra and Sonam Ahuja nationally.

Why now? Company executives said regional stars create substantial pull for first-time consumers.

With demand likely to rise further during Navratri, several brands and sellers have reduced discounts for the rest of the sale period as supplies remain a challenge, multiple industry executives said. Prices of several products across fast-selling categories such as smartphone, television, appliance and fashion are up 5-18% compared with the first two-three days of the sale.

Forrester Research previously said that the e-tailers could clock a record $9.2 billion in gross sales during the festive month starting October 3 and that 70% of this would come in the first week.

Other Top Stories We Are Covering

Swiggy announces $35-40 million liquidity programme: Food delivery platform Swiggy said it will allow employees to cash in stock options worth $35-40 million over the next two years — in July 2022 and 2023. The programme is pegged at $35-40 million at Swiggy’s $5.5 billion valuation following its $1.25 billion funding round in July.

Karnataka gaming ban takes effect: Sequoia Capital-backed Mobile Premier League (MPL) was among the first few gaming startups that began blocking access to users in Karnataka on Wednesday following a ban on online gaming.

Global Picks We Are Reading

- If Facebook is the problem, is a social media regulator the fix? (Reuters)

- Apple to face EU antitrust charge over NFC chip (Reuters)

- Uber can now track your flight so a ride home is ready when you land (CNBC)

( News Source :Except for the headline, this story has not been edited by Rashtra News staff and is published from a economictimes.indiatimes.com feed.)

Related searches :